As we specified before, national governments and their comparing focal managing an account powers detail fiscal arrangement to accomplish certain financial orders or objectives.

Banks and money related approach go as an inseparable unit, so you can’t discuss one without discussing the other In Monetary policy.

While some of these orders and objectives are fundamentally the same between the world’s national bank, each have their own particular extraordinary:

arrangement of objectives brought on by their unmistakable economies.

At last, money related approach comes down to advancing and keeping up value strength and monetary development.

Monetary policy Type

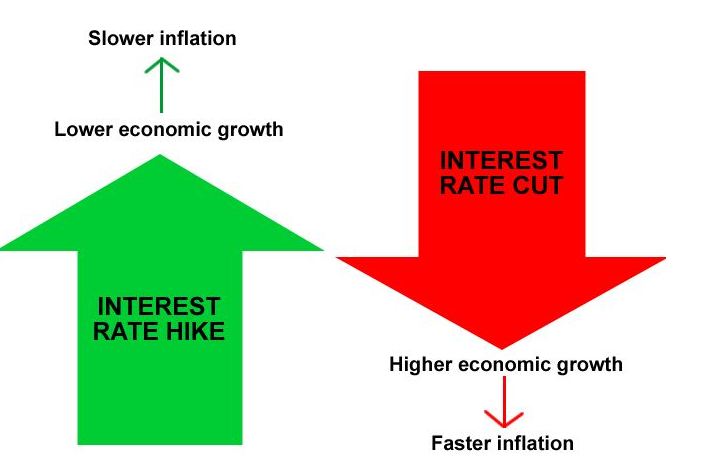

Monetary approach can be alluded to in a couple diverse ways. Contractionary or prohibitive financial strategy happens in the event that it diminishes the extent of the cash supply. It can likewise happen with the raising of loan costs.

The thought here is to moderate financial development with the high loan costs. Obtaining cash gets to be harder and more costly, which lessens spending and speculation by both customers and organizations.

Expansionary financial strategy, then again, extends or builds the cash supply, or abatements the loan fee.

The expense of acquiring cash goes down with the expectation that spending and venture will go up.

Accommodative money related approach intends to make financial development by bringing down the loan fee, though tight fiscal arrangement is set to diminish expansion or limit monetary development by raising loan costs.

At long last, unbiased financial approach plans to neither make development nor battle expansion.

The imperative thing to recall about expansion is that national banks for the most part have a swelling focus at the top of the priority list, say 2%.

They won’t not turn out and say it particularly, but rather their fiscal arrangements all work and concentrate on achieving this safe place.

They realize that some expansion is something to be thankful for, yet crazy swelling can uproot the certainty individuals have in their economy, their employment, and eventually, their cash.

By having target expansion levels, national banks market members better see how they (the national brokers) will manage the current monetary scene.Back in January of 2010, expansion in the U.K. shot up to 3.5% from 2.9% in only one month. With an objective expansion rate of 2%, the new 3.5% rate was well over the Bank of England’s usual range of familiarity.

Mervyn King, the legislative head of the BOE, caught up the report by consoling individuals that interim variables brought about the sudden bounce, and that the present expansion rate would fall in the close term with insignificant activity from the BOE.

Regardless of whether his announcements ended up being genuine is not the point here. We simply need to demonstrate that the business sector is in a superior spot when it knows why the national bank does or doesn’t accomplish something in connection to its objective financing cost.

Monetary Policy Cycles Round

For those of you that take after the U.S. dollar and economy (and that ought to be every one of you!), recall a couple of years back when the Fed expanded loan fees by 10% out of the blue?It was the craziest thing to leave the Fed ever, and the money related world was in a state of chaos

We simply needed to ensure you were still wakeful. Fiscal strategy would never significantly change like that.

Most approach changes are made in little, incremental conformities in light of the fact that the fat cats at the national banks would have utter confusion staring them in the face if financing costs changed drastically.

Only the thought of something to that effect incident would upset the individual dealer, as well as the economy in general.

That is the reason we typically see financing cost changes of .25% to 1% at once. Once more, recall that national banks need value strength, not sudden stunning exhibition.

Part of this dependability accompanies the measure of time expected to roll out these loan cost improvements happen. It can take a while to even quite a long while.

Inflation And Gross Domestic Product

A large portion of us would concur that we need to live in a nation that is focused and has a decent way of life contrasted with different nations around us. A hefty portion of us would likewise most likely like the choice to purchase moderately shoddy outside items for our regular use. Most market analysts would likewise concur that one of the essential universal objectives of macroeconomic arrangement is to keep up the position of the U.S. as one of the pioneers on the planet economy.

Be that as it may, how does one gauge the majority of this? That is the place the open deliberation starts. Some trust an equalization of exchange deficiency or surplus is the key estimation. Different business analysts may contend that we ought to take a gander at the estimation of the conversion scale. This lesson will concentrate on the conversion scale and how financial and fiscal approaches can influence it and the costs we pay for merchandise each day.

Basics Review

To survey, a swapping scale is just the rate at which one nation’s coin can be exchanged or traded for another nation’s cash. It decides how shabby or how costly it is for you to purchase products, for example, TVs, garments, and tires for your auto. A high conversion scale for the U.S. dollar makes remote monetary forms less expensive, which brings down the cost of imports. This implies you can purchase more gadgets and different merchandise and administrations for each dollar you make!

A low conversion standard makes imports more costly on the grounds that your dollar won’t purchase as much remote coin. Despite the fact that this implies you will spend a greater amount of your paycheck on ordinary regular things, on the other side, it empowers sends out, which can bring about a parity of exchange surplus and offer the economy some assistance with growing.

Since we have recapped a couple of the nuts and bolts, how about we plunge more profound into how financial and money related strategy influence the conversion standard.It can influence trade rates through salary changes, value changes and loan costs. How about we investigate every at this point.

Income Changes

This implies more imports. You have more cash; you need to spend it! The ascent in imports results in U.S. subjects offering more dollars to purchase remote monetary standards to pay for those foreign made merchandise. This reductions the dollar conversion scale, at last prompting more costly items later on.

Price Changes in Monetary policy

When the administration needs to develop the economy, it is known as expansionary strategy. To do this, the administration can lessen assesses or spend more to animate the economy. At the point when the administration spends increasingly or chooses to cut your assessment charge, this at last prompts expanded interest, which pushes the general cost of merchandise and administrations higher.

As the costs of merchandise expands, this likewise makes fares of our products to different nations more costly and imports more alluring. This prompts higher interest for outside cash to purchase products and lower interest for dollars to buy U.S. merchandise. This brings down the swapping scale. Contractionary approach, which is described by a decline in government spending or increments in expenses, has the inverse impact.

Interest Rates changes

Now that we have perceived how wage and value levels can influence the trade rates, how about we perceive how loan fees work. At the point when the administration takes an expansionary monetary approach and needs to expand its spending, it needs to understand that cash from some place. To do that, it offers securities, which raises the loan fees. This higher U.S. loan cost causes remote dollars to stream into the United States in light of the fact that outside financial specialists are pulled in to the higher loan fees, which give them a superior profit for their cash. Individuals are continually searching for a decent profit for their cash!

This expanded stream of capital pushes up the U.S. conversion scale. Unexpectedly, contractionary financial arrangement prompts lower loan costs and more capital streaming out of the U.S. furthermore, pushes down the trade rateMonetary strategy acts similarly as monetary approach in connection to pay. At the point when the cash supply rises or credit gets less demanding (for instance, your capacity to get an advance), the pay in your pocket increments. As our wallets get greater, we spend more cash on imports. As we offer dollars to purchase remote monetary standards so we can pay for those energizing new merchandise, this declines the dollar conversion scale. Then again, contractionary fiscal strategy, which prompts lower cash supply or more tightly credit, causes U.S.

Forex MT4/MT5 Indicators Forex Indicators & Strategies Download

Forex MT4/MT5 Indicators Forex Indicators & Strategies Download