1-2-3 Pattern Indicator V9 This makes it accessible to traders with different trading styles and preferences. One of the key strengths of the 123 pattern strategy is its versatility. It can be used on any timeframe and applied to various financial instruments such as stocks, currencies, commodities, and indices.

The 123 Pattern Strategy is a simple yet effective strategy that can be applied in various financial markets, including stocks, forex, and commodities.

How to trade with the 1-2-3 pattern indicator V9?

This strategy is based on the idea that after an extended trend or movement in one direction, the market tends to retrace before continuing its trend.

The 123 pattern can be identified by looking at a chart and observing three consecutive swing points – a high (peak), followed by a low (valley), followed by another high (peak) or vice versa. A breakout occurs when the price exceeds one of the trendlines forming All Candlestick Charts the triangle formation.

For example, if there is an upward trending 123 pattern, we would look for a bullish breakout above the top trendline. Conversely, if there is a downward trending 123 pattern, we would look for bearish breakouts below the bottom trendline.

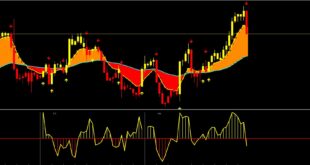

1-2-3 Pattern indicator buy setup

Get pattern with retracement binary option strategy work on candle 123 pattern in chart forex trading.Trad just -pattern with candle high or low means price difference:

in trading buy or sell order in any pair. Retracement indicators strategy show market price in Buy zone or sell zone.

Rules with 1-2-3 Oattern and Retracement

- For buy wait for market price retracement

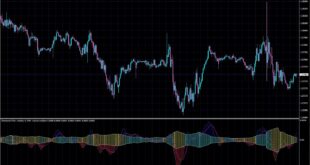

- For sell trading chack price in sell zone with indicator signals.

- Trad M15 or m30 for short term trading.

- Long trad only h4 time frame.

What is the 1-2-3 Pattern V9 indicator?

The 123 pattern is based on the idea that markets move in waves and these waves can be identified and predicted through certain patterns that emerge. the 123 pattern consists of three consecutive price swings, with the first being a significant high or low point, followed by a retracement and then another higher or lower point. This sequence forms an “M” shape for bearish patterns and a “W” shape for bullish patterns.

The first swing represents a strong move in one direction, Harmonic Pattern Indicator either up or down, indicating the presence of a dominant trend. The second swing is known as the retracement and it occurs when prices temporarily move against the dominant trend before resuming its original direction.

1-2-3 Pattern indicator sell setup

This pullback usually ends at around 38.2% to 61.8% of the initial move.

The final swing completes the pattern as prices make another Reversal Candlestick strong move in line with the initial trend, forming either an “M” or “W” shape on a chart. If this third swing breaks above or below the previous high or low point respectively, it signals a confirmation of a reversal.

checking and Drawing the 123 Pattern on Charts

checking and drawing patterns on charts is a crucial aspect of technical analysis in trading. One popular chart pattern that traders often look for is the 123 pattern, also known as the 1-2-3 reversal pattern.

The 123 pattern is a trend reversal formation that consists of three consecutive price swings 1-2-3 pattern indicator forex. It can occur in both uptrend and downtrend markets, making it a versatile trading strategy for traders.

The first swing is usually the longest and marks Cup and Handle Pattern the end of the current trend.

The second swing retraces some of the first swing’s movement but does not exceed its high or low point. The third swing confirms the trend reversal by breaking through the high or low point of the first swing.

Forex MT4/MT5 Indicators Forex Indicators & Strategies Download

Forex MT4/MT5 Indicators Forex Indicators & Strategies Download